Texas title loans for small business owners provide quick financing backed by vehicle assets, but come with risks like repossession. Lenders assess financial history and revenue projections to determine creditworthiness, with variable interest rates potentially impacting long-term stability. Mitigating risks involves understanding loan terms, evaluating collateral implications, adopting repayment strategies, exploring alternative financing, diversifying revenue sources, and practicing strict financial management. Engaging financial advisors specializing in Houston title loans can offer tailored guidance for sustainable business growth.

Texas title loans can provide a quick financial boost for small business owners seeking capital. However, understanding the risks is crucial before securing such a loan. This article delves into the intricacies of Texas title loans specifically tailored for small businesses, focusing on assessing and mitigating associated risks. By examining key factors and implementing strategies, business owners can make informed decisions while navigating this alternative financing option in Texas.

- Understanding Texas Title Loans for Small Businesses

- Assessing Risk: Key Factors to Consider

- Mitigating Risks: Strategies for Business Owners

Understanding Texas Title Loans for Small Businesses

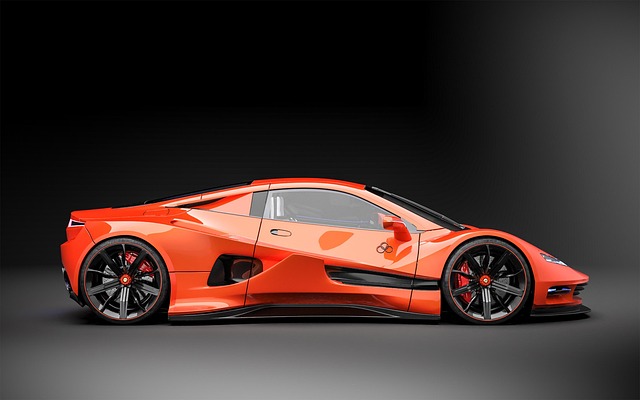

Texas title loans for small business owners offer a unique financing option that can be a powerful tool for entrepreneurial growth. This type of loan utilizes a business owner’s assets, specifically their vehicle, as collateral to secure funding. It’s an alternative lending solution designed to provide quick access to capital, which can be particularly beneficial for small businesses facing immediate financial needs or looking to expand their operations. The process involves a simple and direct approach, where lenders assess the value of the owned vehicle, conduct a credit check, and offer a loan amount based on the vehicle’s appraisal.

One specific type of Texas title loan is the truck title loan, which caters to business owners who rely heavily on their vehicles for daily operations. This option streamlines the financing process even further, as the truck itself serves as both collateral and a vital asset for the business. However, it’s crucial to remember that these loans come with risks, such as repossession if the loan isn’t repaid as agreed. A thorough understanding of the terms, including the vehicle inspection process and credit requirements, is essential before small business owners consider this alternative financing method.

Assessing Risk: Key Factors to Consider

When considering a Texas title loan for small business owners, risk assessment is paramount. Key factors to consider include the business’s financial history, revenue projections, and ability to repay the loan. For instance, boat title loans often appeal to those in need of quick financial assistance, but they come with varying interest rates and terms that can significantly impact a small business’s long-term stability.

Evaluating these aspects helps lenders determine the creditworthiness of potential borrowers. Financial assistance is not guaranteed; it requires a thorough understanding of the business landscape and the ability to mitigate risks. By examining these factors, both lenders and small business owners can make informed decisions that balance immediate needs with sustainable growth prospects.

Mitigating Risks: Strategies for Business Owners

For small business owners considering a Texas title loan as a financial option, mitigating risks should be a top priority. This involves thoroughly understanding the terms and conditions attached to such loans, which often involve using a vehicle as collateral. Securing a loan with your vehicle ensures that in case of default, the lender can repossess the asset, providing some safeguard for their investment. However, it’s crucial to have a solid plan to repay the loan to avoid losing your valuable collateral.

Strategizing for risk mitigation goes beyond just understanding the loan terms. Business owners should explore alternative financing options like traditional business loans or grants. Additionally, diversifying revenue streams and implementing robust financial management practices can strengthen their position. Engaging with financial advisors or consultants specializing in small business financing can offer tailored guidance on managing risks associated with Houston title loans or other forms of cash advances, ensuring the long-term sustainability of the enterprise.

Texas title loans can be a valuable source of capital for small business owners, but it’s crucial to thoroughly assess and mitigate risks before borrowing. By understanding the key factors involved and implementing effective strategies, business owners can navigate this alternative financing option with confidence, ensuring a positive outcome for their ventures. Remember that informed decision-making is key to unlocking the benefits of Texas title loans while safeguarding against potential pitfalls.