Texas title loans for small business owners offer quick capital access secured by vehicle titles but require meeting specific eligibility criteria including solid business standing and personal creditworthiness. Loan amounts are determined by vehicle ownership proof. Stable employment history is key while unique circumstances can impact approval. These loans cater to entrepreneurs with limited credit or business history, empowering growth through inventory purchases, equipment upgrades, or working capital.

Texas title loans offer a unique financing option for small business owners seeking quick capital. This article delves into the state’s regulatory framework governing these loans, ensuring compliance and fairness. We explore eligibility criteria, making it clear who can benefit from this alternative financing method. Additionally, we discuss how Texas title loans can fuel growth, providing insights into successful use cases for small businesses operating within the state.

- Understanding Texas Title Loan Regulations for Small Businesses

- Eligibility Criteria: Who Qualifies for Title Loans in Texas?

- Maximizing Small Business Growth with Title Loan Funds in Texas

Understanding Texas Title Loan Regulations for Small Businesses

Texas title loan regulations are designed to protect both lenders and borrowers, especially small business owners seeking financial support. Understanding these rules is crucial for anyone considering a Texas title loan as a funding option. These loans, secured by a vehicle’s title, offer a quick way to access capital, but they come with specific guidelines that vary from state to state.

Small business owners in Texas must be aware of the lending practices and terms, including interest rates, repayment options, and the process for Boat Title Loans. Repayment plans are an essential aspect, ensuring borrowers can manage the loan without falling into a cycle of debt. By adhering to these regulations, lenders provide access to much-needed cash advances while maintaining fair business practices.

Eligibility Criteria: Who Qualifies for Title Loans in Texas?

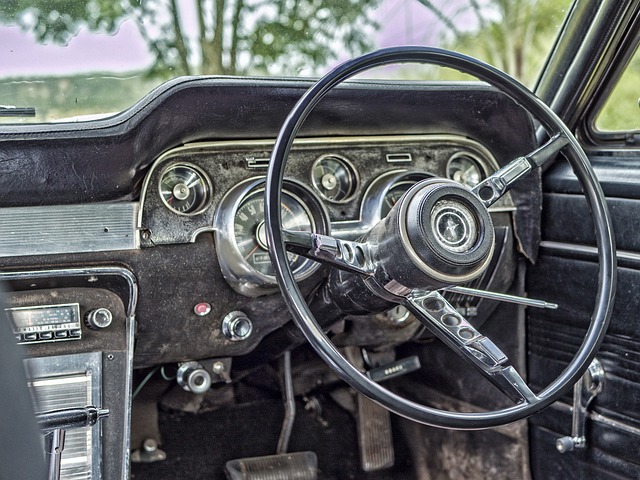

In Texas, small business owners interested in securing funding through title loans must meet specific eligibility criteria. To qualify, applicants typically need to demonstrate a solid business standing and personal creditworthiness. This includes providing proof of vehicle ownership—whether it’s a car, truck, or motorcycle—as collateral for the loan. The vehicle equity plays a crucial role in determining the loan amount offered.

Business owners should be prepared to show stable employment and a consistent history of repaying debts. While traditional credit checks are conducted, unique circumstances and business assets can also factor into the approval process. For instance, those with outstanding vehicle ownership but limited credit history might still qualify for specific types of title loans, such as motorcycle title loans, offering a alternative financing option to small business owners in Texas.

Maximizing Small Business Growth with Title Loan Funds in Texas

In Texas, small business owners can leverage unique financing options to fuel their growth and expansion. One such powerful tool is a Texas title loan for small businesses. These loans, secured against the owner’s vehicle (such as trucks or motorcycles), offer a swift and accessible way to gain capital. By using this alternative financing method, entrepreneurs can maximize opportunities without being burdened by traditional bank loan requirements.

The beauty of a Texas title loan lies in its flexibility. Unlike conventional business loans, eligibility criteria are often more lenient, making it an attractive option for those with less-than-perfect credit or limited business history. Whether it’s funding inventory purchases, equipment upgrades, or working capital needs, these loans can provide the necessary financial push for small businesses to thrive and compete in a dynamic market. With a strategic approach, Texas title loan funds can be harnessed to create a sustainable growth trajectory for any small enterprise.

Texas title loans offer a unique financial opportunity for small business owners seeking quick capital. By understanding the state’s regulations and eligibility criteria, entrepreneurs can access much-needed funds to fuel growth and navigate challenging economic landscapes. These loans provide an alternative financing solution, allowing businesses to leverage their assets and unlock new possibilities. With careful planning and responsible borrowing, Texas title loan for small business owners can be a game-changer, fostering success and prosperity in the vibrant business community.