Texas title loans for small business owners provide quick financial support secured by vehicles, with same-day funding but high interest rates and risk of repossession if not repaid. Eligibility requires proof of ownership, clear vehicle title, good credit, steady income, and successful business operations. While ideal for short-term needs, these loans are a costly and risky long-term solution.

In the dynamic landscape of small business financing, understanding non-traditional loan options like Texas title loans can be a game-changer. This article delves into the unique opportunities these loans present specifically for business owners in Texas. We’ll explore how this alternative lending approach works, who qualifies, and the potential advantages and drawbacks for entrepreneurs seeking capital. By understanding these factors, small business owners can make informed decisions about their financial strategies.

- Understanding Texas Title Loans for Businesses

- Eligibility Criteria for Small Business Owners

- Benefits and Risks of Title Lending for Entrepreneurs

Understanding Texas Title Loans for Businesses

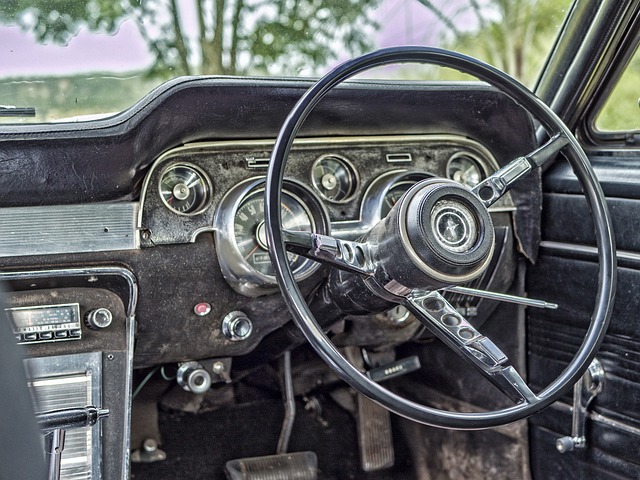

Texas title loans for small business owners can be a rapid source of capital for entrepreneurs looking to access liquidity quickly. These loans are secured by the owner’s vehicle, offering both advantages and potential drawbacks. The primary benefit is the ease of approval; unlike traditional bank loans that require extensive documentation and credit checks, Texas title loans often provide fast approval times, making them an attractive option for business owners needing immediate financial support.

The process involves assessing the vehicle’s valuation, which determines the loan amount. This quick funding mechanism can be particularly useful during unforeseen business expenses or to seize market opportunities. However, it’s crucial for business owners to understand the terms and conditions, including interest rates and potential penalties, to ensure they can comfortably repay the loan without hindering their business operations or facing repossession risks.

Eligibility Criteria for Small Business Owners

Small business owners in Texas looking for quick financial assistance can consider a Texas title loan as an option. To be eligible, businesses must meet certain criteria. Typically, lenders require proof of business ownership and a clear vehicle title. The vehicle used for the loan, which could be a car, truck, or other asset, serves as collateral. This ensures that the lender has a security interest in case the borrower defaults on payments.

Additionally, lenders often assess the overall creditworthiness of the business owner and evaluate the business’s financial health and revenue streams. While specific requirements vary by lender, having a steady income and a proven track record of successful business operations can increase chances of approval for a Texas title loan. Dallas title loans and truck title loans are also available under these conditions, catering to diverse small business needs.

Benefits and Risks of Title Lending for Entrepreneurs

For small business owners in Texas, exploring alternative financing options like a Texas title loan can offer both opportunities and challenges. One significant advantage is the accessibility it provides, especially for those who may not qualify for traditional bank loans. This type of lending is secured by the owner’s vehicle, allowing for quicker approval processes and same-day funding. It can be a viable solution for businesses in need of immediate capital to cover unexpected expenses or seize short-term opportunities.

However, it’s crucial to be aware of the potential risks. A title pawn comes with higher interest rates compared to conventional loans, and if the business owner fails to repay, they risk losing their vehicle. The vehicle inspection process can also be stringent, ensuring the car’s condition meets specific criteria. While this option provides rapid access to funds, it may not always be the most cost-effective or sustainable long-term solution for small businesses, especially with the associated risks and fees.

Texas title loans can offer a unique financial solution for small business owners seeking quick access to capital. By understanding the eligibility criteria and weighing the benefits against potential risks, entrepreneurs can make informed decisions about this alternative lending option. While it provides a much-needed cash flow, it’s crucial to approach title lending strategically, ensuring repayment ability to maintain a positive business landscape. Exploring Texas title loan for small business owners can be a game-changer in navigating financial challenges and fostering business growth.