Texas title loans for small business owners provide swift and accessible financing by leveraging vehicle ownership as collateral. With flexible requirements, lower interest rates, and quick funding, these loans enable businesses to seize opportunities, manage cash flow gaps, and adapt to market changes, fostering growth despite imperfect credit or limited collateral.

“Exploring Financing Options: Texas Title Loans for Small Business Owners

In today’s competitive market, securing funding is a top priority for entrepreneurs. This article delves into an often-overlooked yet powerful resource: Texas title loans designed specifically for small business owners. We demystify this unique financing option, addressing frequently asked questions. From understanding the fundamentals to unraveling eligibility criteria and uncovering its benefits, this guide aims to empower business ventures by offering a transparent view of how Texas title loans can provide much-needed capital.”

- Understanding Texas Title Loans for Small Businesses

- Eligibility Criteria: What You Need to Know

- Benefits and How It Can Support Your Venture

Understanding Texas Title Loans for Small Businesses

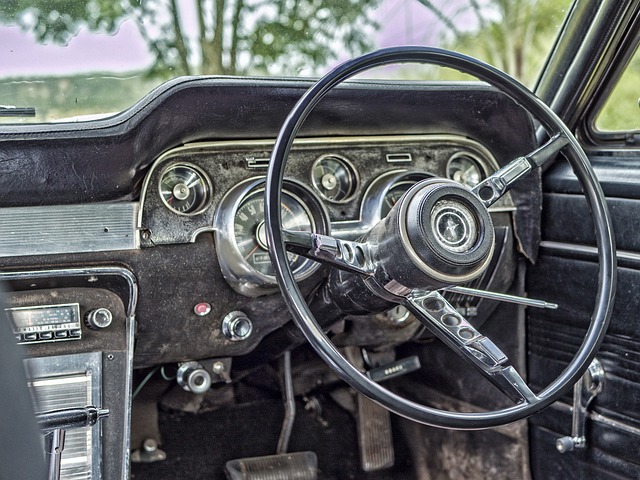

Texas title loans for small business owners are a unique financing option designed to support entrepreneurial ventures within the state. These loans are secured against the owner’s vehicle ownership, providing quick funding when traditional loan applications might face delays. The process is straightforward and often involves less stringent eligibility criteria compared to bank loans or other forms of credit. This makes it an attractive choice for small business owners in need of immediate capital.

The application typically requires a simple form to be filled out, along with proof of vehicle ownership and identification documents. Once approved, the lender facilitates a direct deposit of funds into the borrower’s account, ensuring quick access to the much-needed cash flow. This type of loan is ideal for small businesses facing urgent financial requirements, such as unexpected expenses or opportunities that demand immediate investment.

Eligibility Criteria: What You Need to Know

In Texas, small business owners interested in a Texas title loan for small business owners should meet certain eligibility criteria. Lenders typically require proof of business ownership and financial stability, including tax returns, bank statements, and business licenses. Additionally, applicants must own a qualifying asset like a vehicle (including boat title loans or semi truck loans), which serves as collateral for the loan. This ensures that lenders have a form of security in case of default.

While these requirements are essential for securing a Texas title loan for small business owners, they also ensure that only legitimate and financially viable businesses gain access to fast cash when needed. The process involves providing clear titles and relevant documents, allowing business owners to leverage their assets for immediate financial support.

Benefits and How It Can Support Your Venture

A Texas title loan for small business owners can be a powerful financial tool with numerous benefits designed to support and sustain entrepreneurial ventures. One of the key advantages is its accessibility; compared to traditional bank loans, this option often has less stringent requirements, making it viable for businesses that may not have perfect credit histories or substantial collateral. This flexibility allows small business owners to access much-needed capital quickly, enabling them to seize opportunities, expand operations, or manage unexpected cash flow gaps.

Furthermore, a Texas title loan utilizes the value of your vehicle (specifically its equity) as security, which can offer several advantages. It provides a lower interest rate compared to other short-term financing options, saving you money in the long run. Additionally, with a clear car title and meeting basic eligibility criteria, such as having a valid driver’s license and proof of income, small business owners can secure funds without extensive documentation or waiting periods. This quick availability of capital allows for agile decision-making, enabling businesses to adapt swiftly to market changes and competitive landscapes, including considering investments in new equipment, marketing strategies, or working capital to drive growth.

A Texas title loan for small business owners can be a powerful tool for funding, offering quick access to capital with flexible terms. By understanding the eligibility criteria and benefits, entrepreneurs can make informed decisions to support their ventures’ growth. This article has provided insights into this unique financing option, empowering small business owners to navigate their financial landscape confidently.